Family trusts are a common type of trust used to hold assets or run a family business. A family trust is an “inter vivos discretionary trust” which means it is established by someone during their lifetime to manage certain assets or investments and support beneficiaries, such as family members.

There are certain advantages and disadvantages of family trusts, for example, if you are holding assets in a family trust, you cannot leave them to a specific beneficiary in your Will. We explore these issues in this article and review the parties and processes involved in establishing and maintaining a family trust.

Parties to a family trust

Within a family trust, the beneficiaries are generally related and may include family companies and other family trusts. Registered charities may also be beneficiaries.

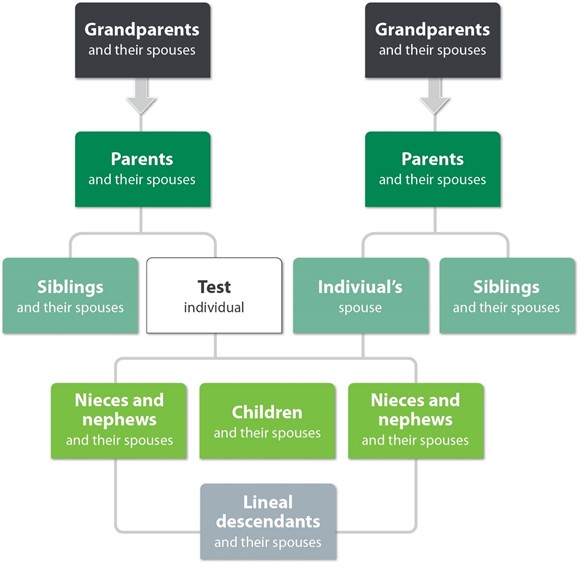

The parties to the trust are determined by the ‘test individual’ – the person whose family group is able to be included as a beneficiary of the trust. The following diagram illustrates the beneficiaries who can be included:

Family trust advantages

There are three main advantages of family trusts:

- Asset protection

- Protecting vulnerable family members

- Tax benefits.

Asset protection

Family trusts are popular structures for protecting assets from bankruptcy or business failure. Because the assets of the trust belong to the trustee and not the individual beneficiaries they cannot generally be used to pay the creditors of individual beneficiaries (unless assets were contributed to the trust with the intention of defeating creditors). They may also be used for protecting family assets from future marriage breakdowns. In the event of a family law property settlement, assets held in a family trust may have a higher likelihood of being excluded from a property settlement than assets held directly by an individual. Holding assets in a family trust can also assist in avoiding challenges to a Will since any assets held in the family trust will not form part of a deceased estate. Retaining assets within a family group can also be a motivator for holding assets in a trust, for example, a family farm.

Protecting vulnerable family members

Family trusts can be beneficial for protecting vulnerable beneficiaries who may make unwise spending decisions if they controlled assets in their own name. A spendthrift child, or a child with a gambling addiction can have access to income but no access to a large capital sum that could be quickly spent.

Family trusts may also provide tax benefits to enable the family group to manage the tax of the family unit. This can be particularly helpful in supporting adult children who are studying or older parents who are retired as they are likely to be in a low tax bracket.

Family trust disadvantages

There are, however, several disadvantages of family trusts:

- Any income earned by the trust that is not distributed is taxed at the top marginal tax rate

- Distributions to minor children are taxed at up to 66%

- The trust cannot allocate tax losses to beneficiaries

- There are costs involved for establishing and maintaining the trust

- Running the trust can become particularly difficult when family disputes arise.

Establishing a family trust

To establish a family trust it is necessary for the trustees of the trust to make an irrevocable family trust election.

Source: IOOF, Australian Executor Trustees