Much has been written recently about the relative merits of taking an active approach or just letting your funds track an index.

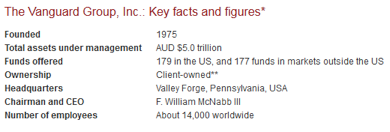

The growth of passive funds has been extraordinary. The head of Vanguard in Australia was in the news last week as the FUM have grown to $5.4 trillion of which $2.9 trillion is tracking indices around the world.

Vanguard has 20m investors around the world, with management fees on average 12bps.

You can see how attractive these Exchange Traded Funds (ETFs) have become. Platinum Asset Management dropped its fees this week to 1.35%, still far higher. Transaction costs are key to keeping the costs down for ETF fund managers. Last year the team at Vanguard traded $100bn of stocks around the Asia Pacific region.

Active managers have struggled in the recent bull market, with 75% of local active managers underperformed the benchmarks.

Now passive investing may be good in a bull market but what happens in a bear market?

There are now questions emerging about whether we have reached peak passive’. Currently 13% of investment dollars is in passive investment globally.

The growth of the industry has coincided nicely with the post GFC recovery and subsequent bull market. The big unknown is how these funds will handle redemptions and liquidity in the event of a sizeable fall?

Is liquidity an issue?

The theory goes that the liquidity you see on the ASX screen is the tip of the ice berg. The fund manager will be able to handle large selling by buying the ETF and then unwinding the underlying instrument. Sure, there may be some difference in theoretical price and the actual price paid in the market, but for the long-term viability of the instrument and the institution behind the instrument it is in its interest to provide liquidity. That is the theory.

There is a saying that everyone has a plan until they get hit in the face by Mike Tyson.

But the ETF world of passive investment has not really been stress tested. Getting transaction costs down has been the key to their success. These ETFs try to replicate an index or instrument, holding the least number of stocks to replicate that index. It does not want to rebalance every day as that would increase costs. The business is all about replication at the cheapest price.

As such they own huge shareholdings in some of our blue chips. For instance, the BlackRock (own iShares) group has 86.9m shares in Commonwealth Bank or around 5%. This concentration of large positions poses no risk when things are going along fine. But one risk is the growth of leverage ETFs and exotic ETFs that promise exposure at cheap prices and other benefits. These use leverage and are somewhat opaque in nature and are more akin to active funds than passive.

Pure index tracking funds are giving way to index tracking with bells and whistles. No point in five ETFs replicating the same thing. Much better for business to add a little kicker or some leveraged alpha to the ETF. Maybe the investor though does not realise the alpha comes at a cost in terms of risk profile. This leads to more risk to the market generally.

The risk grows when Mike hits you.

This gives you some idea of the growth of the ETF market since they were introduced to the ASX back in 2010.