The presence of looming geopolitical hotspots and the shocking Israel-Hamas conflict sparks obvious questions about the global economic outlook. As we approach the end of 2023, Brad Potter, Head of Australian Equities at Tyndall AM discusses how higher interest and inflation rates, geopolitical developments and evolving market dynamics will shape the landscape in 2024.

Source: Brad Potter, Head of Australian Equities – TyndallAM – December 2023

The year that was

The Ukraine war continued while we experienced the sharpest monetary policy tightening in decades. The USA has subsequently experienced the fastest disinflation in modern history while unemployment remained low, and GDP ran above trend – strange times.

Locally, inflation has started to moderate after 13 rate rises, although it remains elevated versus historical standards. Unemployment is near all-time lows, annual wages growth hit a 14 year high of 4% in the September quarter and labour productivity has declined over the past 12 months. This is not helpful for inflation and the potential for further rate rises in 2024 cannot be discounted.

China growth was weak throughout 2023 in the post-reopening phase. Reflation policies were ramped up in the latter part of the year with investment and support for infrastructure and industry. Housing has been weak throughout 2023, impacting China’s GDP. However, the Chinese government has initiated several new measures to support housing, including a decision to issue CNY 1 trillion of incremental government debt for local government spending. Despite weak housing, iron ore prices have remained elevated, suggesting that demand is strong in infrastructure and industrial uses. Port and steel mill iron ore stocks are low and thus a re-stocking cycle will likely keep prices above US$100/t for some time yet.

The trade tensions between China and Australia have reduced, as several tariffs have either been removed or are in the process of being removed. The Australian dollar fell during the year as the USD strengthened, while market uncertainty and weakness in China drove a windfall for exporters.

In October, the Israel-Hamas tragedy unfolded and has now led to the Israeli Defense Force moving into Gaza to remove the Hamas terrorist organisation. A risk premium on oil and gold initially occurred, though this fell away as confidence grew that the conflict will remain contained within the borders of Israel and Gaza. The prospect of lower global growth is now starting to adversely impact the oil price given the implications for demand.

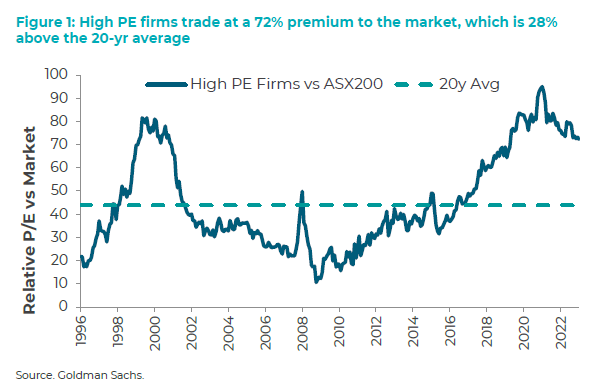

The magnificent 7 in the US (Apple, Microsoft, Alphabet, Amazon, Nividia, Tesla & Meta) have virtually driven all the returns of the S&P 500 during 2023. The rally in these growth names have helped lift the performance of high PE stocks in the Australian market and continue to drive a massive diversion in value.

The year ahead

In 2024, interest rates and inflation are expected to remain higher than those experienced in the 2010’s. The long periods of low inflation, zero-bound interest rates, quantitative easing and the associated negative yielding bonds during the 2010s are now a distant past. The market has not yet adjusted to this new regime and we expect opportunities will emerge. Geopolitical hotspots, such as Russia-Ukraine, Israel-Gaza and China-Taiwan will continue to be focal points in 2024. All three have the potential to escalate, causing substantially adverse impacts on the world economy and markets. The tragedy of the conflict between Israel and Hamas has not significantly spread beyond Israel and Gaza. However, if Iran becomes involved, it has the potential to impact on energy supplies, particularly through the Strait of Hormuz, ultimately leading to dire global economic consequences. The build-out of renewables is starting to hit roadblocks in obtaining regulatory, environmental and heritage approvals. Achieving Labour’s 2030 renewable energy target seems unlikely.

It has become apparent that central banks are close to – or have completed – their rate hike cycles. Therefore, the next moves are likely downwards towards the latter part of the year once they curtail persistent inflation, but we don’t expect a return to low inflation and zero rates of the past. Following years of negative real interest rates resulting in macro assumptions overwhelming company-specific factors, we are now in a new period where fundamental analysis will dominate. Long live fundamental analysis and stock picking!

A spotlight on sectors

Building Materials

The outlook for the Australian and US building material sectors is unsurprisingly dominated by interest rates – not necessarily the outlook for rates, but more their recent movement, given the lags in timing for rates to flow through to construction activity and building materials demand. Unsurprisingly, in the context of the rate rises we have seen, the segments with the weakest outlook for CY24 are the more residential-focused segment in Australia and the US. Non-residential activity and infrastructure activity have more positive outlooks (in Australia, at least, given these segments are of little interest in the US).

More specifically, Australian housing commencements are expected to be around 2% higher than the CY23 level of 167k. We see risks to the downside, given the significant decline in new home sales in the first half of CY23, and the lags between sales and commencements have only been getting longer (possibly as long as 18 months). Non-residential activity is expected to continue, with solid but unspectacular growth of 2% (following 3% growth in CY23). Infrastructure activity, especially roads, is expected to be steady at a high level following 7% expected growth in CY23. Given that the listed company exposures are more generally weighted towards housing segments, we would not expect strong performance from more housing-related stocks in Australia, e.g., CSR.

In the US, housing starts are expected to grow around 4% off significantly weaker levels (down 11% in CY23). The declines have been tempered by the lack of existing housing stock available in the US (given the fixed rate nature of mortgages in the US) and the ability of the big homebuilders to offer rate buydowns to potential buyers. We see little reason why this should change significantly in CY24. The longer-term housing shortage and full employment should provide support to the market. Repair and remodel (R&R) activity is likely to plateau to lower levels, delivering a modest 1% improvement in CY24. Reliance Worldwide remains our preferred exposure at this stage given the significantly better value it offers relative to James Hardie.

Consumer Discretionary

During COVID, most of the listed discretionary retailers performed well, with sales rising as much as 60% above pre-COVID levels. With the COVID impacts on consumer behaviour receding, the normalisation in revenue has commenced. We expect this shift will accelerate as working from home declines and spending on services (e.g. travel) rebounds to more normal levels. On top of this impact, the rapid increase in mortgage rates has seen spending by households with the least financial reserves drop. Combined, the COVID normalisation and the rate-driven impact on discretionary spending is expected to result in much weaker revenue for discretionary retailers.

Weaker demand is expected to lead to lower profit margins as discounting increases. Labour is a significant part of the cost base and is increasing at a high rate. These factors will lead to lower margins and, coupled with the lower revenues, profits are expected to fall significantly.

Travel stocks are different in that they are benefitting from the post-COVID normalisation. We expect strong increases in volumes, revenues and profits for travel stocks. Much of this improvement appears to be already embedded into stock prices.

Banks

Net interest margin pressure, cost inflation, high investment spend, and muted loan growth are all factors that will adversely impact bank earnings during 2024. Asset quality remains pristine, and capital is strong; thus, these two factors are unlikely to be an issue, albeit loan losses will rise off a low base. Valuations for the banks are not stretched, except for CBA, but operating momentum is not strong at present. CBA remains one of the most expensive commercial banks in the world, trading on Price/Book that is two-times higher than the other banks.

ANZ is differentiated from the other big four banks as it is underweight retail and has a large institutional bank with strong operating momentum. This is driven, in part, by a growing transaction banking business and a consistently performing trading markets business.

Consumer Staples

Staples are generally acting defensively, with stable revenues and rational markets. Weakness in consumer spending is having a negligible impact on revenue. Cost of goods inflation is being quickly passed on to customers due to sensible competition. Cost increases are increasingly an issue, with higher staff costs expected to have an impact in the future. Labour is a large part of the cost base, so investment in capital is being made to offset these pressures. Cost outs through capital-driven productivity improvements take a long time, so those companies which consistently invested during COVID are well placed to drive efficiency improvements.

The pricing of staples appears to have overcompensated for the “attractiveness of the defensiveness.” While they have performed well, there seems to be little to drive earnings growth significantly higher.

Healthcare

The healthcare industry should begin to see normalisation in the year ahead, following a turbulent year inundated by uncertainty. The notion of COVID ‘recovery’ and ‘backlogs’ has mostly been cycled through, the fundamental issues across the sector being cost pressures and labour shortages.

GLP-1 drugs should continue to be a point of contention, as more clinical trials reveal the range of impacts these drugs could have. Many uncertainties remain – including compliance, relapse rates and funding – with the year ahead to provide more colour on these issues. In particular, the impact of GLP-1s on Obstructive Sleep Apnea (OSA) and subsequently on ResMed’s volumes is a core uncertainty for the year ahead. However, we remain confident in the under penetration of continuous positive airway pressure (CPAP) therapy and the potential for GLP-1 awareness to guide patients into the CPAP funnel.

CSL should see strong growth coming from the launch of Hemgenix, updates on CSL112 and the Rika rollout, aQIV and continuing integration of Vifor. However, numerous threats loom, including FcRN and Ferinject generics and continuing efforts to reduce plasma costs per litre. Ramsay Health Care should continue to see a gradual recovery in volumes and margin; nonetheless, we remain cautious of its highly leveraged balance sheet position – debt cost pressures are rising – and private health insurance negotiations. Sonic Healthcare is expecting a ‘transition’ year, as the loss of COVID-revenue and residual costs continue to drive margins lower.

General Insurance

The general insurance sector is expected to finally see signs of margin expansion over the next 12 months or so. The sector has seen meaningful premium rate increases over the last couple of years and, more recently, rising interest rates have improved investment income. However, up until now, these increases have been offset by above average claims activity from heightened weather activity, strong claims inflation, and rising reinsurance costs as reinsurers seek to recoup their costs. However, as claims inflation moderates over time, reinsurance costs stabilise, and the likelihood of more normal levels of weather-related claims activity, we expect to see profits improve as the benefits start to flow through to the bottom line. While some of this has already been reflected in share prices, we do see material further upside in share prices. Our portfolio remains overweight the sector.

Diversified Financials

This sector encompasses a mix of different financial industries. The ongoing shift to passive and in-housing of investment capability continues to pressure fund manager margins and funds under management. Only those with strong and consistent outperformance will see their share prices rewarded. Within the wealth management space, the large incumbents will continue to find conditions challenging as they struggle to capture flows away from the smaller and more nimble players who are perceived to be more innovative and independent. Any improvement in market movements and sentiment will be a positive for both industries. Computershare’s outlook appears positive as they benefit from higher interest rates, which are likely to stay elevated for at least the near term. The company should also start to see its core activities rebound as financial market sentiment stabilises.

Oil & Gas

We remain constructive on the outlook for the oil and gas sector. Demand for oil and gas is resilient despite increased electric vehicle (EV) penetration and risks to global economic growth. While road travel has experienced significant demand destruction, deferred EV penetration targets in the EU and increased geopolitical risk bode well for peak oil demand from road use to the end of the decade. Hard to displace non-road based oil & gas users such as air travel, shipping, petrochemicals and heavy industrial use will be challenging to transition.

As such, and with the world increasingly dependent on reliable and secure energy sources, oil demand already exceeds forecasts made by industry bodies just 12 months ago. While we are optimistic for a resilient demand outlook, key risks to demand continue to be the pace of adoption of renewable energy, battery storage and EV penetration in both the developed and non-developed worlds. Increasing penetration of unfirmed renewables provides opportunities for gas, where both piped gas and LNG can provide secure and dispatchable sources of energy. This is providing a resilient demand profile for gas, which has a lower carbon intensity than thermal coal.

While we acknowledge the merits of moving towards a lower carbon future, the global community increasingly realises that conventional sources of firm and reliable energy will be required for a longer period. Recently, the UK delayed its critical climate change targets, while many countries are re-embracing nuclear power, and even extending the useful lives of coal-fired power plants or deferring shutdowns. Germany, a leader in the EU’s energy transition, recently confirmed that, based on the current pace of solar roll out, they won’t hit their own required renewable penetration targets by 2030. We expect this trend to continue, with nations moving away from ambitious targets as the economics and execution times place pressure on transitioning plans.

The increasing reliance on conventional sources of energy, however, does not alleviate the increasing barriers to entry for conventional energy projects, with permitting and the cost of capital increasing. Companies are increasing payout ratios at the expense of exploration and development. At the same time, as fields decline and the sustaining projects to backfill lost volumes are of declining resource quality, unconventional production is entering an increasingly challenging regulatory environment. In the inflationary and rising rate environment, capital requirements have increased, placing more upward pressure on the marginal cost of production.

Geopolitical uncertainty continues to impact energy markets, with the Russia-Ukraine conflict showing us the global vulnerabilities that permeate our supply chains. Caution with events unfolding in the Middle East region could heighten risks further for oil supply. With US shale supply incentives shifting from growth to a more economically rational approach, OPEC is less concerned with another US shale boom and is more focused on monetising its oil resources before demand peaks. Saudi Arabia’s actions are keeping oil prices in a sweet spot for longer. Given stated spare OPEC capacity, monitoring OPEC’s cohesion is crucial as it navigates the transition, the geopolitics and a potential global growth downturn.

ESG and regulatory certainty has been a major issue for Australia’s oil and gas sector following court challenges to key projects for Santos and Woodside. The challenges ultimately pave the way for future regulatory risks for Australian oil and gas assets. We expect challenges to delay projects rather than stop them outright, since these projects are critical to the transition and the Australian economy more broadly. Whether domestic gas users in Australia will be shielded from price volatility depends on domestic gas field discovery and development as the race to find firm power escalates.

Mining

Steel-making raw materials have rallied late in 2023 as Chinese steel production has remained resilient in the face of weak real estate demand and wider economic uncertainty. However, Base metals have weakened due to an uncertain US and EU growth outlook, with reasonably flat copper and aluminium demand meeting supply growth. Battery metals (e.g. nickel and lithium) have given up significant ground from earlier in the year, as weaker than previously expected EV demand fundamentals and a strengthening supply outlook has caused pricing to falter. At the same time, geopolitical uncertainty and stubborn inflation have allowed gold to maintain its positive momentum.

Steel raw materials can expect to enjoy some demand stability as property bottoms out sometime over 2024, and the completions cycle – important for property developer cash flow – continues to support residential steel demand. Chinese credit easing policies and property reform will continue in their aim to stabilise the property sector, but the expectation of “big bang” stimulus is fading as China reports relatively moderate economic growth. In contrast, India continues to demonstrate robust economic growth and an inherent need to increase commodity intensity per capita.

Looking beyond the short term, supply-side dynamics in the steel raw material space may generate two materially different outcomes: (i) iron ore supply growth from projects in the Pilbara, West Africa, and Brazil; and (ii) an increasingly constrained metallurgical coal growth environment where permitting, higher costs of capital, and increasing Australian state government royalties increase barriers to entry. In the absence of demand growth, the production growth in iron ore may lead to a moderation of prices to levels more consistent with marginal price economics. Meanwhile, met-coal scarcity pricing will remain until new high-quality seaborne supply sources can meet growing Indian demand, as the world finds it difficult to decarbonise blast furnace steel making.

Over the longer term, limited supply-side growth beyond what is currently being executed and ramped up may lead to prolonged supply and demand deficits for copper as grade decline and resource depletion meets increased barriers to entry (e.g. permitting issues, declining fiscal and political stability of endowed nations and declining resource quality in investable jurisdictions). The copper supply dilemma may only be solved by addressing one of three challenges: (i) monetising lower grade resources in tier one jurisdictions; (ii) taking increased jurisdictional risk; or (iii) exploring deeper to find untapped high-grade resources. With increasing costs of capital, the higher breakeven costs for these decisions will benefit incumbents such as BHP and Rio Tinto.

Telecommunications

We view the telco industry as a core defensive exposure for the year ahead, given the macro sensitivity and industry dynamics. From a macro perspective, we expect telcos will be able to expand margins, since labour costs are a less significant part of their cost base compared to other defensive sectors (e.g. supermarkets), and revenues are increasing with inflation as demand for data continues to grow at pace.

The risk to this thesis is that competition may escalate, leading to price growth discipline evaporating. We are observing a very rational market, with strong leadership from Telstra which has committed to annual CPI price increases. Vodafone has also increased prices, and Optus has started the process. More price rises are expected from Aldi Mobile and other budget brands, which should give Optus confidence to take the next step up. We take confidence from the stated return targets of all the players who have invested heavily in their 5G networks and now need to generate a return on that investment.

Transport

The listed transport sector in Australia is a mixed bag. We have more confidence in those exposed to commodities – such as Aurizon and Qube – than we do to consumer facing businesses like Qantas. Brambles is likely to see another 12 months of strong price growth, but our recent US research trip showed that the there is a glut of pallets in the market and discipline may be difficult to maintain. While Qantas is presenting some value and we are watching it closely, the earnings assumed by the market are anchored to recent history and are not representative of a sustainable margin for the business.

The secular value rotation is just starting

The value of a company is often not the same as its price, with price being what you pay and value is what you receive. While price and value can diverge by a wide margin in the short to medium term, over the long term they should converge.

Tyndall has always viewed value investing as a philosophy rather than a factor. Our process has always aligned with the approach from Benjamin Graham, the father of value investing. We value companies based on their sustainable earnings capacity. We determine the intrinsic value by capitalising the sustainable or mid-cycle earnings of every stock under coverage and triangulate this valuation with alternate measures. At its core, value investing is buying companies that are trading below their assessed net worth, having a disciplined approach, being patient and often taking a contrarian stance.

The valuation gap between growth and value remains extraordinarily wide, despite declining rapidly during 2022 (Fig 1). The tailwinds for growth post the global financial crisis are unlikely to return anytime soon, and higher bond yields through Sept-Oct 2023 saw a 12% P/E derate. Higher inflation and interest rates are here to stay and we expect the elevated valuations still being priced for growth will derate further over time. Value remains well below the long term trend vs growth (Fig 2) and thus we believe some further reversion is warranted.

Fear and greed are some of the most powerful long-term alpha generators. We continue to take advantage of these market dislocations in a patient and disciplined manner. While tough market conditions can be painful for any manager, they’re not new to our experienced team, and it’s times like these when we maintain conviction and stay true to our proven process that has provided long-term alpha for over 28 years.

Source: Brad Potter, Head of Australian Equities – TyndallAM – December 2023