Whilst ‘don’t put all your eggs in one basket’ is a well-used adage, it is still relevant today and means, don’t have all your money in one place as you could lose it all in one go.

You may have heard the saying ‘don’t put all your eggs in one basket’ but you may not know that – here’s a fact to impress your friends and excel at pub quizzes – it’s attributed to Miguel de Cervantes who wrote Don Quixote in the early 1600s. It’s widely thought of as the world’s first modern novel.

Whilst ‘don’t put all your eggs in one basket’ is a well-used adage, it is still relevant today and means, don’t have all your money in one place as you could lose it all in one go.

Putting eggs in different baskets

Fear of losing money is one of the reasons that people may be wary of investing, but putting your money into different investments (your imaginary eggs going into a series of baskets) can help reduce some of the risk.

In technical terms, this is called diversification. It just means spreading your money into different investments, such as equities, bonds, cash, and property.

Why should I split my money across multiple baskets?

Let’s say you choose to have some of your money in a cash savings account so that it is easily accessible. You’re also on the property ladder, so you have money invested there, and you have superannuation invested in a mixture of shares, bonds, property and cash.

This is an example of investing in different asset classes and it is important to do, as not all asset classes are affected in the same ways by different economic events. If you don’t want to do the diversification yourself, you could buy into a fund that does it for you.

When one investment basket (asset class) doesn’t perform so well in the market, another may outperform, which can provide some protection against major losses to your money and investments.

You can also diversify your investment within an asset class itself. For example, if choosing to invest in equities, you could choose both large and small companies, those in different sectors and those in different geographical locations. You could also take a similar approach if investing in bonds, including the option of choosing to invest in corporate or government bonds.

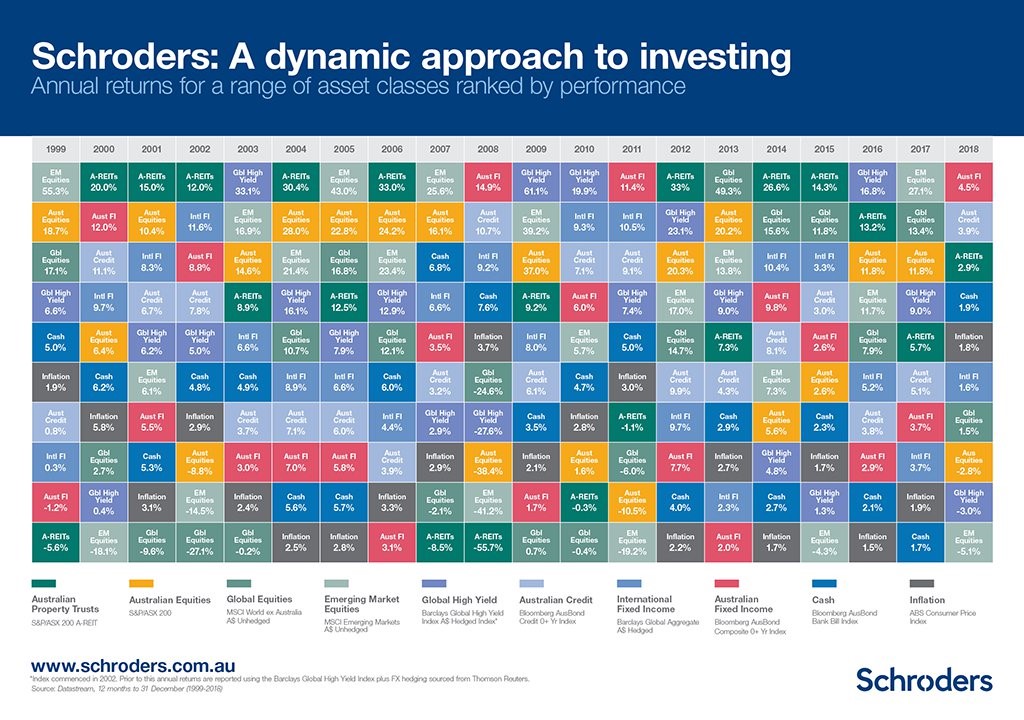

Returns of different investment ‘baskets’ over the past 20 years

Investment returns vary significantly between different investment ‘baskets’, or asset classes, year-to-year. The chart below clearly demonstrates this by showing the relative performance of different asset classes over the past 20 years. It emphasises the importance of spreading your investments across different asset classes to protect your money against loss while trying to achieve your financial goals.

Finding the right balance: don’t over do it

Finally, make sure that you don’t over do it. Putting your money into lots of different investment baskets can only reduce risk up to a point and not remove it entirely. All investment has some risk. Also, holding too many different investments doesn’t allow any of them to have much of an impact, so work with your financial adviser to choose what suits your situation best.

Whatever your approach to not ‘putting your eggs in one basket’ is, the key takeaway is that diversification can help manage your investment risk. And should you want to impress your friends, tell them the basics of diversification along with the origins of the saying.

Source: Sally Hoolin, Investment Writer