What does independence mean to you?

What does independence mean to you?

Making your own decisions?

Being able to give up work?

When ANZ conducted research into this topic it received some interesting, and some alarming, answers.

Most Australians (73 per cent) feel independent in their life, ANZ found in its in-depth survey of 1000 Australians in March this year. This was a state defined as being “secure, safe and happy” and “responsible for their own lives” because they can look after themselves financially.

Independence is a priority for most Australians, now as well as in the future, with women significantly more likely to feel it’s “extremely important” now (31 per cent) compared to men (25 per cent). Women are also significantly more likely to feel that independence means “not having to rely on others” while men feel “being in control” best describes it. Women were also more likely (8 per cent) to feel independent after they got divorced or separated.

What role does money play in people’s independence?

- One third (33 per cent) of people say independence is “financial freedom”.

- For 19 per cent it is not having any debt

- For 29 per cent of Australians, independence is “having enough money to live my life”.

- And 38 per cent say super is their main asset in their plans to live a fully independent life.

A super-charged independence

Almost all Australians are thinking about the money they’ll need in retirement with 9 in 10 saying they have something in place. Superannuation is a key strategy to save money (for one fifth, it is their only strategy), but many Australians also plan to continue working and develop alternative savings to give them the independence they’re looking for in life. Looking at the stats by gender reveals some disparities.

- Almost half (45 per cent) of women and 40 per cent of men are relying on their standard employer super and paying off their mortgage.

- Women (34 per cent) are more likely than males to have a budget in place (27 per cent).

- And 20 per cent of women are making additional super contributions compared to 18 per cent of men.

- However, only 23 per cent of women plan on having an investment property compared to 24 per cent of men.

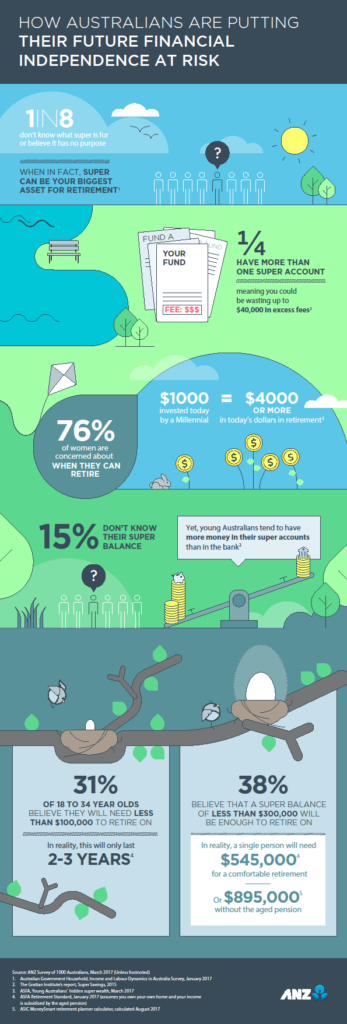

Even though super has this important role, when it really comes to getting a grip on super, things start to go fuzzy for Australians. One in eight don’t know what super was or believed it had no purpose, 15 per cent don’t know how much super they have, women were even less engaged than men with 18 per cent likely to have no idea of their current balance compared to 12 per cent of men. And many wildly underestimate how much they need to have a satisfying, independent life post work.

This lack of engagement is problematic for women, in particular, considering that a large divide persists between men and women when it comes to super balances.The latest HILDA (Household, Income and Labour Dynamics) survey showed men still have almost double the superannuation of women. The mean balance of super at December 2015 was $454,221 for men and $230,907 for women.

The disconnect between expectations and reality

Of those who agree that super is their main asset, 72 per cent are concerned about whether they’ll have adequate funds for retirement.

- Women are significantly more likely to be concerned (76 per cent compared to 63 per cent of men).

- Women were more likely than men to know how much they’ll need in retirement (11 per cent compared to 6 per cent of men).

- Approximately 38 per cent of people believe that a super balance of less than $300,000 will be enough to retire on.

- And 31 per cent of 18-to-34 year olds believe they will need less than $100,000.

Katrina Horrobin from The Association of Superannuation Funds of Australia (ASFA) says financial independence is very important for all Australians in retirement but not everyone achieves it.

“The age pension is sufficient to avoid absolute poverty in retirement but just avoiding poverty is not a goal that Australians aspire to,” she says. “Superannuation is the key to financial independence and to a life of greater dignity and comfort in retirement.”

How much for a comfortable retirement?

So what causes that disconnect between people’s expectation they’ll rely on super for their financial freedom while remaining disengaged from it?

Horrobin says many people simply aren’t aware of how much money they need to retire.

To help educate people, the association developed retirement standards for a”modest’ and ”comfortable” lifestyle (presuming you own your own home and you’re a healthy 65 year old).

- The “modest retirement” standard is $24,250 a year for a single. (A budget for fairly basic activities, and a slight improvement to life on the age pension.)

- A “comfortable retirement” annual income would be $43,665. (Which means you can be involved in a broad range of activities and have a good standard of living).

- Renters will need more than $1 million in savings. Other organisations advocate $1 million as the ideal figure for everyone entering retirement.